Index

This topic area covers statistics and information relating to financial resilience in Hull including local strategic need and service provision. Further information can be found in the Adult Health and Wellbeing Survey 2019 report within Surveys under Tools and Resources. General information relating to Deprivation and Poverty is available under Health and Wellbeing Influences. Further information relating to unemployment and benefit claimants can be found within Employment, Economy and Healthy Workplaces under Health and Wellbeing Influences.

Further information relating to the increases in the rental properties and mortgage and landlord repossessions can be found within Housing and Households under Health and Wellbeing Influences.

Headlines

- Lack of financial resilience reduces life chances, and can have a detrimental effect on educational attainment, employment prospects, housing and health, as well as having substantial impact on emotional wellbeing.

- Prior to the COVID-19 pandemic and the recent cost of living crisis, from Hull’s Health and Wellbeing Survey conducted during 2019, six in ten of people in Hull said they would use savings of money from their current account to fund a £200 household emergency. However, only 36% said they would exclusively use these finances – 48% said they ‘would’ or ‘might’ use more than one method to fund the £200.

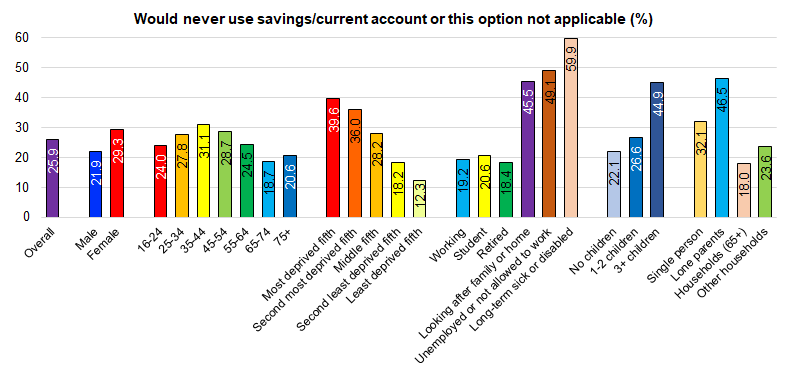

- Over one-quarter would never use savings or a current account to fund this emergency or stated this option was not applicable to them. This was highest among working-age people who were not working, lone parents, households with three or more children, and anyone living in parts of Hull where deprivation is the highest. It is estimated that around 54,100 adults in Hull would never use savings or a current account (or said this option was not applicable) to fund a £200 household emergency.

- Emotional wellbeing was much lower among those with low financial resilience.

- Furthermore, from the same survey, 4.4% of all people worried ‘most days’ and 4.3% worried ‘about once a week’ about not having enough food to eat because of a lack of money or other resources. This equates to 18,500 adults in Hull who worry each week about not having enough food to eat. A slightly higher percentage worried about paying their rent or mortgage and other essential bills like utilities (7.0% worrying ‘most days’ and 3.4% worrying ‘about once a week’).

- The COVID-19 pandemic and the cost of living crisis have impacted significantly on the financial circumstances and financial resilience of the people of Hull. Furthermore, the impacts have not been felt evenly with the people in Hull affected to a greater degree than elsewhere due to the already high levels of deprivation and poverty, and even within Hull. People in the worst financial circumstances in Hull are affected to a greater extent than people living in the ‘better off’ households in Hull. The cost of living crisis is likely to continue for some time with further increases or relatively little change in the cost of energy, food and other costs anticipated. Rents continue to increase as do monthly mortgage payments for those households not on fixed interest rate deals. This will further exacerbate financial vulnerability and increase the inequalities gap for Hull residents.

The Population Affected – Why Is It Important?

Financial resilience is the ability of individuals and families to weather financial shocks and it is central to economic and emotional wellbeing. Life chances and prospects of young people are greatly affected by the financial resilience of their parents, and the state is also affected by the financial resilience of its residents. Lack of financial resilience can impact on educational attainment, employment prospects, housing and health, as well as having substantial impact on emotional wellbeing.

The Hull Picture

The local adult Health and Wellbeing Survey which involved over 4,000 adults (aged 16+ years) in Hull conducted during 2019 included information relating to the financial method used to fund a £200 household emergency and the frequency of worrying about worrying about having enough food and about paying bills.

Further information is available within the Financial Resilience Health and Wellbeing Survey 2019 report.

Deprivation

Based on the Index of Multiple Deprivation 2019, Hull is the fourth most deprived local authority in England, and as a result there are high levels of poverty, debt and lack of financial resilience.

Further information is available within Deprivation and Poverty under Health and Wellbeing Influences

Financial Method to Fund a Household Emergency

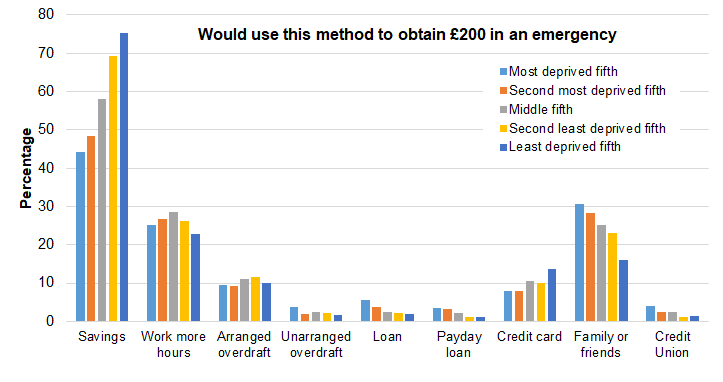

Overall, 60% would use their savings or money from their current account to fund a £200 household emergency, but this differed substantially by deprivation fifths. People living in the most deprived fifth of areas of Hull were much less likely to use their savings or current account compared to people living in the least deprived fifth of areas of Hull (44% versus 75%).

Just over one-quarter of all adults would never use their savings or current account to fund a £200 household emergency (or said this option was not applicable to them). This assumes that one in four would struggle to fund a (relatively inexpensive) household emergency. The percentage was considerably higher among people living in the most deprived areas of Hull, who were unemployed or not working due to long-term illness or disability, lone parents, and among households containing three or more children. Overall, this equates to around 54,100 adults in Hull who would never use their savings or current account to fund a £200 household emergency or said that this option was not applicable to them.

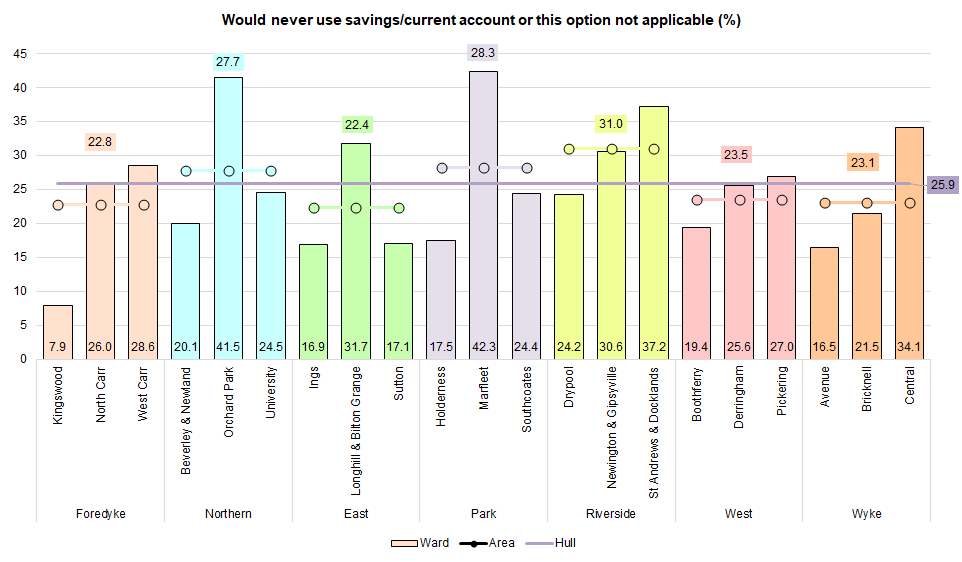

There were large differences across the 21 electoral wards in Hull. One in twelve (7.9%) residents of Kingswood would never use their savings or money from the current account to fund a £200 household emergency but this was more than four in ten (42%) residents of Marfleet and Orchard Park wards.

Emotional wellbeing was much lower among those with low financial resilience. Among those people who would not be able to fund a £200 household emergency from savings or from their current account:

- 37% had high levels of anxiety

- 26% experienced low levels of happiness

- 24% had low satisfaction with life

- 21% had low levels of feeling life was worthwhile

Among those able to fund the emergency from their savings or current account, 29% had high levels of anxiety, 11% experienced low levels of happiness, 10% had low satisfaction with life, and 8% had low levels of feeling life was worthwhile. Whilst finances will impact on these measures of wellbeing, many other factors may be involved.

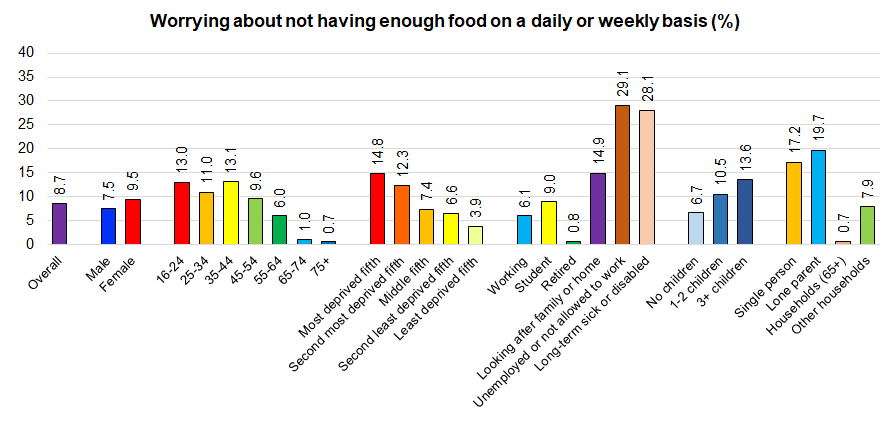

Frequency of Worrying About Having Enough Food and Paying Bills

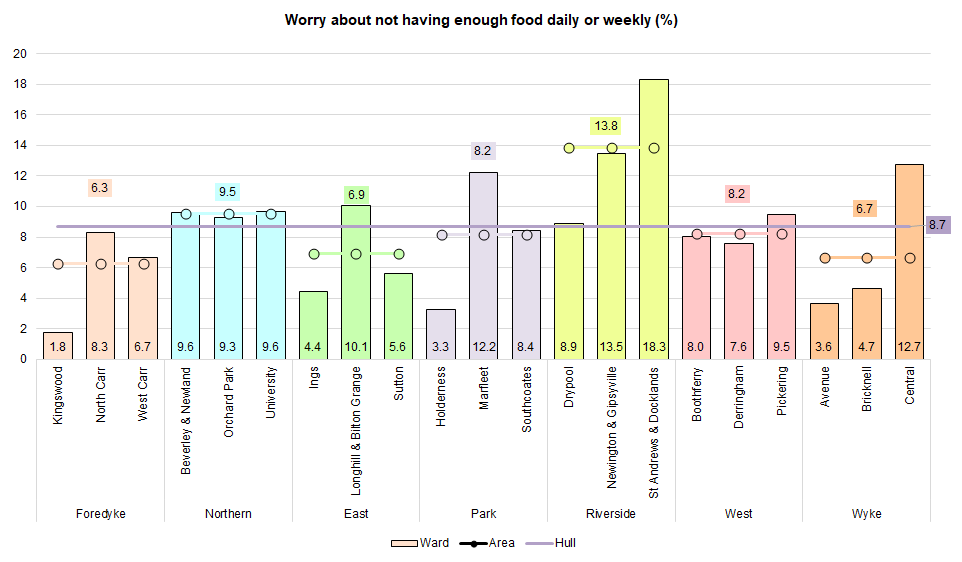

Overall, 4.4% of all people worried ‘most days’ and 4.3% worried ‘about once a week’ about not having enough food to eat because of a lack of money or other resources. This equates means around 18,500 adults in Hull worry each week about not having enough food to eat. Almost three in ten people who were unemployed or not working due to long-term illness or disability worried most days or weekly about not having enough food as did 20% of lone parents. Less than 1% of retired people worried weekly about a lack of food.

Fears of not having enough to eat were higher in areas with high levels of deprivation, and was highest among residents of St Andrews and Docklands, with 18% worrying every week.

Slightly higher percentages worried weekly about paying their rent or mortgage, and other essential bills like for utilities. One in ten worried about these bills ‘most days’ (7.0%) or ‘about once a week’ (3.4%). This equates to more than 22,000 adults worrying each week about paying their essential bills.

Low Income Households

The relative levels of deprivation in Hull as well as the percentage of households in fuel poverty and the percentage of children living in low income families is given under Deprivation and Poverty within Health and Wellbeing Influences, although the information presented generally predates the COVID-19 pandemic and recent price increases so does not fully illustrate the current circumstances of people in Hull in relation to finances. Further information relating to unemployment and benefit claimants can be found within Employment, Economy and Healthy Workplaces under Health and Wellbeing Influences.

COVID-19 and Cost of Living Crisis

The financial resilience information from the Health and Wellbeing Survey predates the COVID-19 pandemic. There were many low income households in Hull working on zero hour contracts or on furlough during the COVID-19 pandemic and this resulted in income loss for many households in Hull.

Furthermore, at the end of 2021 and in 2022, the cost of gas and electricity increased dramatically, and these increases have continued into 2023. The cost of food and other products also increased, as well as the overall inflation figure for the the UK. In April 2021, the annual inflation rate was 1.5% but has increased since then to a high of 11.1% in October 2022. This was the highest inflation rate recorded since March 1992. Between October 2022 and January 2023, the inflation rate has decreased slightly to 10.1% in January 2023, and further fell to 8.7% for April and May 2023, reducing to 7.9% in June 2023. Inflation is still very high in relation to inflation over the last 30 years, and is likely to remain so for some time. Whilst salaries have increased over the last year, the inflation rate is considerably higher than those increases meaning that salaries have reduced in real terms (after adjusting for inflation).

For those not on fixed price energy contracts, the cost of energy prices started to increase in 2021. Whilst the government put a cap (maximum) on the unit cost of electricity and gas, the cap was considerably higher than the prices in 2020 and early 2021. In April 2022, the cap was increased which resulted in much higher costs, and the cap was further increased in October 2022, although the government introduced the Energy Price Guarantee which runs out in March 2023. The cap is due to increase further in April 2023 which might be slightly alleviated by the warmer weather and decreased energy consumption. Between October 2022 and March 2023, every household received financial support from the government in relation to their energy costs, with lower income households receiving more funding. However, this government funding only covers a proportion of the price increases.

Between 2009 and 2020, the Bank of England’s interest rate has been below 1%, and fell to a low of 0.1% between May 2020 and December 2021. With the increasing inflationary pressures on the economy as a way to attempt to reduce the inflation rate, the Bank of England started to increase the base interest rate in December 2021. The latest rate as at July 2025 is 4.25%. For home-owners paying a mortgage who are not on a fixed-interest rate deal, their monthly mortgage payments have increased dramatically, by hundreds of pounds a month. This may have also affected landlords, and household rents have also increased in the last 2-3 years. Further information on the median (‘typical’ value – middle value when sorted in order) cost of buying and renting a home in Hull and the recent increases in rental costs can be found under Housing and Households within Health and Wellbeing Influences.

Households in Hull were already struggling financially following in the COVID-19 pandemic which increased the inequalities gap in Hull. The current and future impact on energy, food, mortgage and rents, and other costs will only magnify this further and further increase the significant inequalities that already exist when comparing Hull with other places in England, as well as exacerbating the inequalities within Hull.

Further information relating to the trends in the number of mortgage and landlord repossessions can be found within Housing and Households under Health and Wellbeing Influences.

From the Health Foundation’s report into children and young people’s mental health and COVID-19 and the road ahead, in 2021, children and adolescents with a probable mental health condition were twice as likely to live in households newly falling behind on bills (12.8%, compared with 6.7% of 6 to 16-year-olds without a mental health condition).

Citizens Advice Cost of Living Dashboard

Hull & East Riding Citizens Advice have produced a Cost of Living dashboard (www.hullandeastridingcab.org.uk/cost-of-living-dashboard/) which details the number of people seeking help and advice from Citizens Advice in relation to the cost of living crisis. Their dashboard is updated monthly and the latest version gives information up to and including the previous month. The data refers to clients seen by Citizens Advice throughout England and Wales.

In April 2014, around 30,000 people seeking help each month across Citizens Advice throughout England and Wales, but this increased to around 50,000 by March 2020. Whilst figures reduced considerably during the first few months of the COVID-19 pandemic, the numbers steadily increased thereafter to reach around 70,000 people seeking help each month by March 2021. The numbers tend to fall in April which might be associated with warmer weather and reduced energy bills, the end of the financial year and fewer issues with council tax arrears. Around 55,000 people sought help in April 2021 but this increased to around 95,000 people by March 2022. Around 75,000 people sought help in April 2022 but this increased to around 115,000 people by March 2023. Numbers fell to around 90,000 people per month in April 2023, but steadily increased in May and June 2023 in a similar manner to the last two years. The dashboard no longer gives the total number seeking help each month, but it is likely that numbers have increased since mid-2023.

The main key cost of living issues since 2014 have been personal independence payments (PIP), energy, energy debts, charitable support and food banks, and council tax arrears. The main increases since 2014 have been related to energy and charitable support and food banks.

By December, a cumulative annual total of 3,001 people in 2019 had been unable to top up their energy prepayment meters, but has increased each year to 4,764 in 2020, 8,366 in 2021, 27,521 in 2022 and 38,111 in 2023. As at June 2024, 16,309 people had been unable to top up their energy prepayment meter, slightly lower than the same time last year when it was 17,833 people. Numbers are lower this year, probably for a number of reasons; a warmer (but wetter) winter and spring (February 2023 was the warmest on record), factors such as Ofgem’s temporary ban on forcing people onto prepayment meters, Cost of Living payments and benefit uprating.

In terms of crisis support which involved food bank referrals and emergency charitable support, the numbers have also increased substantially since 2019. By December, a cumulative annual total of 74,510 people were helped in 2019, but this increased to 96,463 in 2020, to 135,441 in 2021, to 200,517 in 2022 and to 210,096 in 2023. As at May 2024, a cumulative total of 96,800 people having been helped in relation to crisis support which is higher than the 86,962 people at the same time (May) in 2023.

So far in 2024 (to May 2024), 152,559 people have been helped with energy issues, compared with 150,380 to the same month a year before. A total of 236,969 people were helped in 2022, compared with 337,225 in 2023.

So far in 2024 (to May 2024), 34,887 people have been helped with homelessness issues which is higher than the same point in any of the last nine years (next highest was 29,188 in 2016).

In January 2019, the top five key cost of living issues were related to PIP (19,583 people supported), Employment Support Allowance (14,113 people supported), Universal Credit initial claims (12,557 people supported), council tax arrears (11,534 people supported) and energy (10,945 people supported) and crisis support did not feature in the top five issues. Later in 2019, crisis support did feature with between 7,000 to 9,000 people supported although this increased between 2019 to over 18,000 people in January 2021, to 24,000 people in January 2022 and reached a high of 26,000 people supported in February 2022. Figure did decrease slightly over the next few months but then gradually increased to most than 30,000 in December 2022. Figures have reduced to 25,070 people for June 2023. Around 10,000 people were supported in relation to help with energy each month for winter 2018/19 and 2019/20, but this increased to a peak of 17,000 for 2020/21, to 23,000 for 2021/22 and to 34,000 people for 2022/23.

The Citizens Advice Cost of Living Dashboard clearly shows that people living in Hull, and people living in different circumstances are much more likely to require help. Across England, people who are disabled or with a long-term health condition, single people, lone parents, people who are social tenants, women and those aged 55-64 years were most likely to have been helped since January 2022 compared to other age groups, but those aged 35-44 years were most likely to have been helped in relation crisis support.

Half of all people with debt issues are in a negative budget situation even after being helped by Citizens Advice advisors in that their necessary expenditure exceeds their income. The highest percentages occurred for lone parents (53%), single people (52%), Asian or Asian British (54%), from mixed or dual heritage ethnic backgrounds (55%), people who were disabled or had a long-term health condition (51%), people aged 45-64 years (54%), people who were unemployed (63%) or self-employed (59%), those in rented private accommodation (56%) and men (53%).

Strategic Need and Service Provision

It is recognised that financial resilience is low in Hull, but following the local survey it has been possible to better quantify the levels of financial resilience. Further work in Hull is ongoing with this regard. However, this survey was conducted in 2019 and the COVID-19 and the cost of living crisis has changed the financial circumstances of many people in Hull drastically since then.

The impact of the COVID-19 pandemic had adversely affected the poorest, most deprived areas of the country the most. This was the case for Hull. The educational and training opportunities, labour market, employment opportunities and circumstances of people in Hull as well as levels of poverty, debt and financial insecurity were already considerably worse than most local authorities in England prior to COVID-19, and the consequences of COVID-19 will have widened the inequalities gap in relation to education, employment, the labour market, poverty, debt and financial insecurity. This has now been compounded by the marked increases in energy costs which has impacted on food and other costs increasing the rate of inflation to the highest rate it has been in the UK for 30 years. Furthermore, the prices are anticipated to increase even further.

Resources

Local Health and Wellbeing Survey 2019

Trading Economics. United Kingdom Inflation Rate. https://tradingeconomics.com/united-kingdom/inflation-cpi

Bank of England. Interest Rates and Bank Rate. www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate

Hull & East Riding Citizens Advice. Cost of Living Crisis Dashboard. www.hullandeastridingcab.org.uk/cost-of-living-dashboard/ and https://public.flourish.studio/story/1775087/

The Health Foundation. Children and young people’s mental health. COVID-19 and the road ahead. https://www.health.org.uk/news-and-comment/charts-and-infographics/children-and-young-people-s-mental-health

Updates

This page was last updated / checked on 23 July 2025.

This page is due to be updated / checked in July 2026.